Please edit the title of your You Should Know post to begin with “YSK”. It’s Rule 1 of the community. Thank you.

Thank you

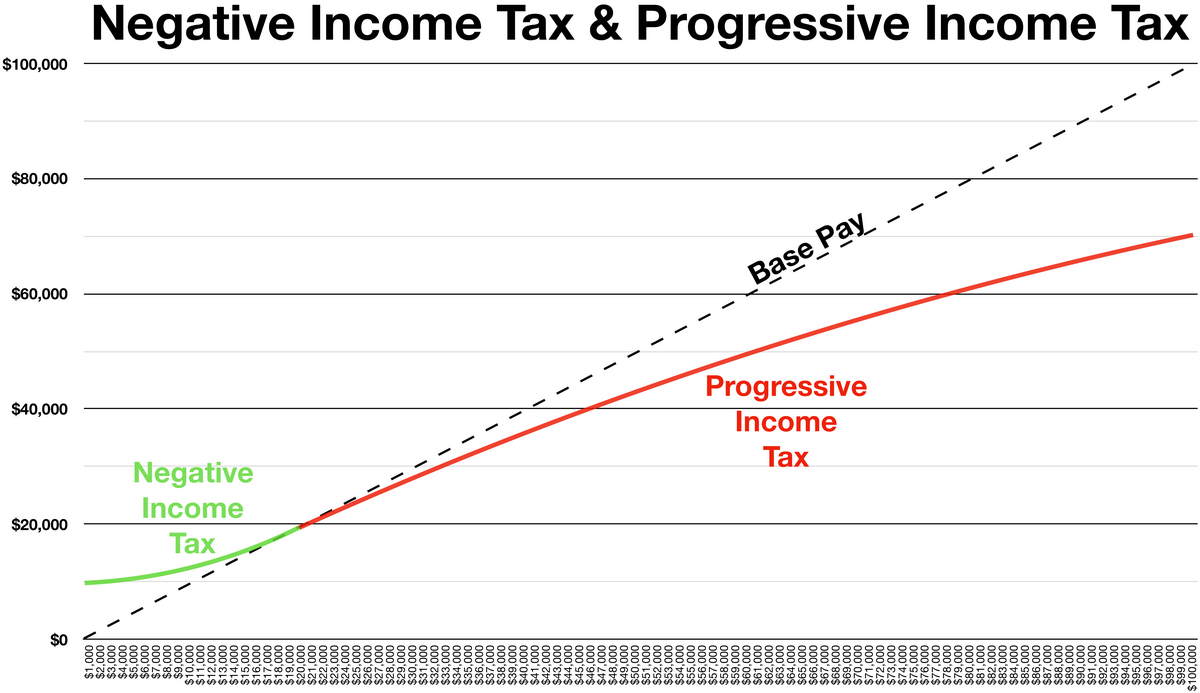

Negative Income tax could operate like UBI. The hero of neoliberalism Milton Freedman supported a scheme to transfer wealth like this.

You say negative income tax, I hear business subsidies.

Also, in “things that will never happen in the US” we have universal healthcare

That’s just equivalent to UBI, isn’t it? If you pay out UBI and get the money for it from taxes, then there’s an income level below which people net gain money and above which people net lose money.

No, negative income tax usually requires that you make some money and file taxes. UBI doesn’t.

One has the intention of encouraging workforce participation. The other tries to help everyone.

It is UBI with a “clawback”. Conservative (Friedman’s NIT version) and left wing (called Guaranteed income) versions of UBI like to place an ultra high tax/clawback rate on the lowest income levels. It is same as UBI if lower tax brackets are not the first bracket after “personal UBI received is paid back in taxes”

How is it a negative income tax if they are taking money from the lowest bracket? That’s the bracket where an NIT gives money instead of taking it.

A NIT of 50% up to $20k income is equivalent to UBI of $10k with 50% as the lowest tax bracket. Under both, you pay 0 net tax at exactly $20k income, and you get a $10k refund at 0 other income.

Either one is still a 50% marginal tax rate no matter the name. On every $ you earn you only keep 50cents.

This still doesn’t make sense to me. The UBI clawback that starts small and grows with each bracket makes sense. At 0 earned you get 20,000. And it’s not until you hit the poverty line that it starts gradually being taxed back. So a family of four would pay 5 or 10 percent back if they were in the 40k-50k bucket.

It seems to me you’re not discussing a NIT which pays money to workers, but rather a national minimum wage through the tax system. In this case 10,000 dollars. An NIT doesn’t need a clawback because it diminishes as you go up in tax brackets. A UBI uses it to remove administrative overhead from issuing it and to make it clear that every adult, employed or not, is eligible.

NIT is paid to workers and non workers alike. As is UBI. The maximum NIT refund you get is at 0 earned income. When you earn income, your refund is lowered. That starts at $1 of income. Even if it is called a negative tax, it is still a positive marginal tax rate that reduces your net income for every $ earned.

An NIT refund comes from the IRS, while UBI can come from IRS or another department. They are still highly related concepts. Other than the most famous NIT proposal has a 50% tax rate on the lower incomes, and frequenly left leaning politicians, instead of UBI propose Guaranteed Minimum Income, with tax rates of 50% to 100% on the lowest incomes.

Sensible UBI plans use normal tax rates with higher rates on upper incomes if needed.

When you say a tax rate of 50-100 percent, are you referring to the negative tax rate?

Guaranteed minimum income plans are either a 100% tax, when literally, all get a minimum income of say $20k, if you earned less than $20k, you don’t keep any of those earnings. Practical, still left of center plans do change this to a more modest 50% clawback rate similar to welfare/EI. The most famous NIT proposal had a 50% tax rate on the lowest income. That is the exact same as the flawed GMI plans.

This gets proposed as a way to implement basic income (UBI). It is only equivalent when the lowest tax bracket is equal to the NIT.

ex: if NIT of 25% up to $40k, and 25% income tax rate up to $50k, then at $40k income, you would pay 0 net income tax. At 0 income, you would receive $10k, and at $50k income, you’d pay $2500. Every $10k of income results in $2500 extra taxes or less of a refund.

Milton Friedman’s version of NIT was at 50% for low income ($20k), and then fairly low tax bracket rates (20%) above that. This means that the poorest people are taxed very high on income, and middle to high incomes pay a lower rate. Welfare and unemployment systems often use such a 50% clawback. It is a significant disincentive to work, unless you will make a lot during a year.

Refundable tax credits is a similar system of permitting net refunds to people even if they pay no income taxes.

Let’s be honest, if the US did something like this, the ultra wealthy who are already not paying taxes would find ways to game more money out of the system.

But it could still help a lot of people.

Wouldn’t it make more sense to, like, have the first 12k dollars tax free and then increase the percentage for everything exceeding this threshold? The more money you earn, the more taxes you can afford to pay. Especially when you earn only little money this is important for you to survive, while $100k/yr managers could easily afford to pay 50k of those in taxes

A negative income that is better than that. It says, if you’re working, but only making $12k, the state will give you money so you now have $20k. (Not real numbers.)

The idea is that it incentivizes participation in the work force, with hopes that the extra money helps you get stable and move up the payscale where you may stop needing the external support.

How does that incentivizes workforce participation? You’re giving them money to not work, I think graduated taxes should just not have the NIT portion.

No. If you reported $0 in income on your taxes, you get nothing. There’s a minimum income to get anything back. So if you don’t work, you get nothing, so you are incentivized to find a job of some kind.

But that minimum should be quite low and attainable.

NIT is specifically letting people start in a refund position. 0 income gets the largest total refund.

Ah got it.

What a bad set of graphs! The first one is just wrong.

Good thing it’s a wiki!